Nearly 150 years ago, the grandfather of science fiction, Jules Verne, said that water will become the coal of the future. The man who posited the possibility of traveling to the Moon and underwater ocean exploration, proved to be a visionary on fuel sources too.

With the EU curbing coal emissions in the hope of slowing down climate change and perhaps even reversing some of its effects, energy companies have been pulling all the stops to meet the ambitious goals.

Even the ruling Law and Justice, though historically lukewarm on renewable energy, has been tossing pretty impressive figures around. The Minister of Climate and Environment, Anna Moskwa, recently stated that about 73% of Poland’s electricity production will come from renewable energy and nuclear power by 2040, as per the updated Polish Energy Policy.

H2 IS IN

One of the main prongs in the new energy strategy is going to be made of hydrogen, the latest “hot” energy source. State-backed players are pulling any and all market stakeholders into the hydrogen game.

Energy Group, a photovoltaics producer, and Hynfra, a manufacturer of energy storage batteries, signed a contract for €22 billion to produce renewable hydrogen, ammonia, and methanol.

“Watching global and European markets, we see how fast investments related to the production of green hydrogen and ammonia are growing. In our opinion, both are essential elements of green transformation and decarbonization,” the managing director of Energy Group Marian Glita said.

Fuel giant PKN Orlen has announced its plans to invest PLN 7.4 billion in hydrogen, including opening three hydrogen refueling stations: in Poznań and Katowice in 2023, and in Wałbrzych at the beginning of 2025.

INFRASTRUCTURE IS KEY

While the number of industries, outside electricity generation, interested in the virtually unlimited energy source is expectedly long, the transport industry is clearly one of the main contenders to the podium. Municipalities across the country are more than eager to attract hydrogen investments, knowing full well that to be competitive, you need to be accessible.

The city of Rybnik recently touted its plans to open a second commercial hydrogen fueling station, near a public transport station. “This will be Poland’s second commercial, publicly available hydrogen fueling station. The hydrogen supplied to the station will come entirely from renewable sources, from so-called green hydrogen. The investor plans to put the station into operation in the second quarter of this year,” said Agnieszka Skupień, a spokeswoman for the Rybnik municipality.

A network of fueling stations is absolutely essential to make inroads into passenger and cargo transport, which is a lesson learned from building the electric car segment. After years of slow adoption, the market for electric cars nearly doubled last year. The number of new registrations for battery-electric and hydrogen-powered cars soared 91.2% in February 2023 year-on-year, and reached 1,155 units, based on data from the Polish Automotive Industry Association.

The growth is all the more impressive when compared to the more conservative options: the number of plug-in hybrids (PHEV) registered rose by 20.7% to 991 units in the same period. While the growth is noteworthy, the green car segment is still relatively small and accounts for approx. 3% of new passenger car registrations.

HYDROGEN-FUELED SOLARIS

The growing attraction towards hydrogen options is also observed among bus and coach manufacturers, as demonstrated by Solaris, a Polish bus producer that has been owned by the Spanish group Construcciones y Auxiliar de Ferrocarriles since 2018. The Solaris Urbino 12 hydrogen has been contracted for more than 200 units, 100 of which are already driving on the streets of Bolzano in Italy, Cologne, and Wuppertal in Germany, the South Holland region, and Konin in Poland.

The company’s latest model, an 18-meter hydrogen-powered bus, premiered back in the fall of 2022. Solaris has already received its first orders from the German carrier Stadtwerke Aschaffenburg Verkehrs. The German company purchased two Urbino-18 and 10 Urbino-12 hydrogen buses to be delivered in 2024. Municipal transport operator Hamburger Hochbahn has ordered five Solaris Urbino 12 hydrogen buses. The zeroemission vehicles are expected to appear on Hamburg's streets as early as the second quarter of 2024.

HYDROGEN VALLEYS

Any new technology requires brainpower and with the industry turning towards hydrogen, Polish companies are looking to source expertise and talent, which so far is scarce. This is why the energy giants have decided to partner up with universities and other stakeholders to educate their own future staff.

In late 2022, Orlen partnered up with Toyota and the Polish train manufacturer PESA, as well as several universities: Łódź and Warsaw technology universities, as well as a research center of the Polish Academy of Science. Between March and June 2023, the first Hydrogen Academy will educate cherry-picked grad students, lured in by paid internships and a potential offer of lucrative employment in a very promising industry. “Hydrogen is the fuel of the future and we need specialists who will help build this future,” said Daniel Obajtek, Orlen’s CEO.

Another industry-university partnership quickly followed suit: chemical producer Grupa Azoty joined forces with the West Pomeranian University of Technology and created a Hydrogen Academy in Szczecin, part of the West Pomeranian Hydrogen Valley.

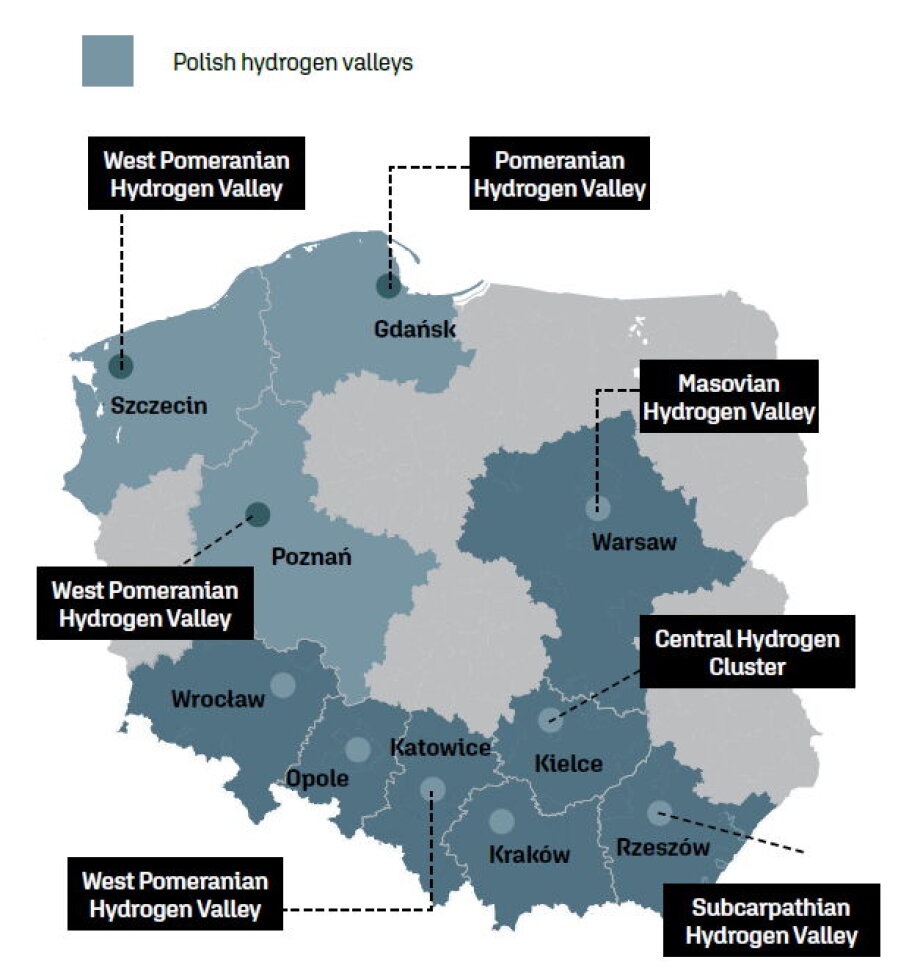

Just like automotive and aviation valleys in the past decades, hydrogen valleys started cropping up in Poland’s industrial centers in rapid succession. The current number of hydrogen industry clusters is eight and cover mostly western and southern Poland.

While eight may not be a staggering number, it has already exceeded the plans laid out in “Poland’s 2030 Hydrogen Strategy” adopted by the Council of Ministers in November 2021, which aimed at creating five hydrogen valleys by 2030. The document also envisaged putting 800-1000 new hydrogen buses to use, with up to 32 hydrogen fueling and storage stations.

_____

What is “green” hydrogen?

In contrast to gray hydrogen,which is generated from natural gas, green hydrogen comes from water. It is produced through electrolysis, a process of separating water into one atom of oxygen and two atoms of hydrogen. Currently, green hydrogen makes up less than 1% of global hydrogen production, but that is poised to change.

Another advantage of green hydrogen is that it can be transported using the existing gas pipelines, so in many cases the existing infrastructure may be sufficient for the new fuel. And it can also be used to produce green ammonia, the main component of common fertilizers. In view of current fertilizer shortages brought on by the war in Ukraine, finding an alternative source of fertilizers is of paramount importance.

How is hydrogen safe?

After the 1937 Hindenburg disaster, in which the airship caught fire and crashed, the use of hydrogen as fuel was deemed too hazardous or impractical to be secure. What makes the current storage technology safe enough to use hydrogen in passenger cars?

Firstly, hydrogen is stored in tanks constructed from materials that are highly durable and less likely to rupture or ignite. These tanks are engineered to contain any probable leaks. Secondly, significant advancements have been made in the development of sensors that can identify hydrogen leaks, pressure relief systems, and shutoff valves. The substantial investment in research and the increasing knowledge in the field make hydrogen fuel cells not only safe for storage but also quite convenient for transportation without compromising power.