Avison Young: report on investment market in Poland H1 2025

By Paulina Brzeszkiewicz-Kuczyńska, Research and Data Manager at Avison Young

Investment market–so far so good

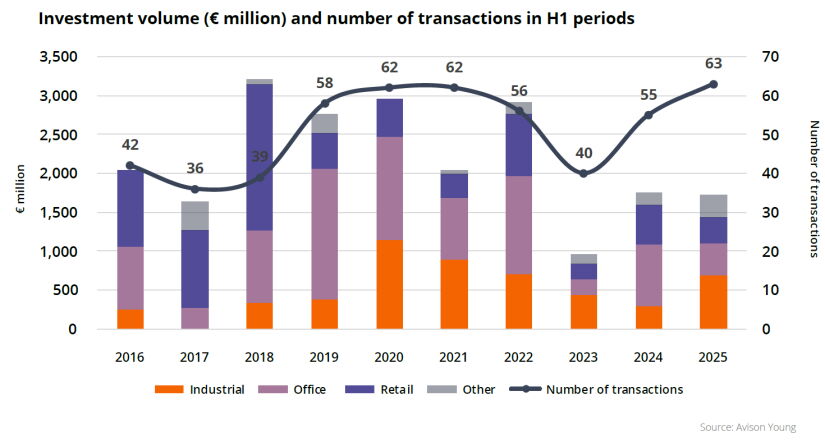

The first half of 2025 brought a surge of activity to Poland’s commercial real estate market, with a total investment volume of ca. €1.7 billion across 63 transactions. Assets traded covered all major sectors of the market, with the industrial segment attracting the largest share of capital and delivering some of the most notable transactions. However, excluding the largest sale & leaseback deal in CEE closed in Q2, transaction volumes did not exceed €80 million.

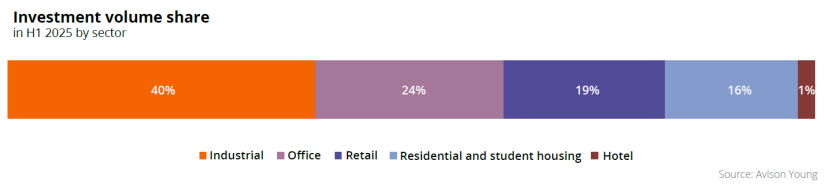

In total, the industrial sector accounted for 40% of overall investment volume in Poland. Office assets were transacted both in Warsaw and across key regional cities. The retail sector, recently focused on retail parks and shopping centers in secondary cities, also saw significant redevelopment sales. The residential segment represented 13% of the total investment volume across 6 deals.

The Polish commercial real estate market is currently defined by subdued activity among institutional investors, many of whom are still contending with the declining valuations of their assets and remain cautious in pursuing new acquisitions. This trend mirrors broader global dynamics.

“At present, investment activity in Poland is largely driven by private capital, including a growing share of domestic investors due to attractive pricing. Polish capital is becoming increasingly visible across commercial real estate transactions, not only in residential, with 14% share in total investment volume and average transaction value ~ €13 million.” – says Bartłomiej Krzyżak, Senior Director, Investment at Avison Young

H1 2025 highlights:

• H1 2025 investment volume at the level of H1 2024 results

• €1.7 bn - total investment volume in H1 2025

• 63 transactions in H1 2025

• The largest sale & leaseback deal in CEE closed in Q2 2025

Industrial market–sector with undiminished potential

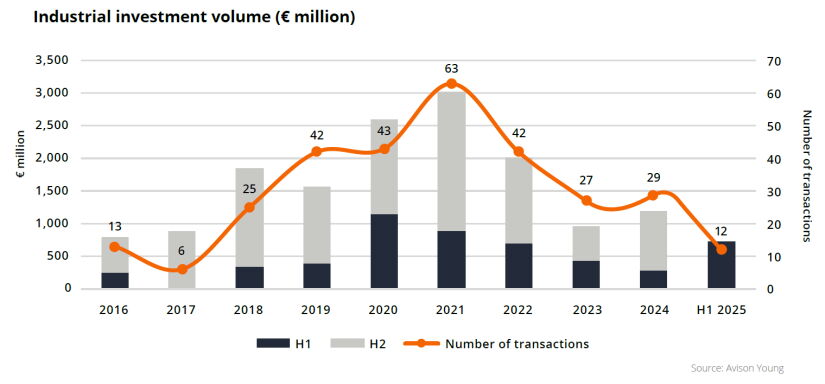

The warehouse sector ranked first as the top-performing segment of the commercial real estate market in Poland. In the first half of 2025, it generated the highest investment volume, accounting for 40% and recording the most spectacular deal.

In April, the largest sale & leaseback transaction ever completed across the entire CEE region was finalized, exceeding €253 million. U.S.-based REIT Realty Income Corporation acquired two facilities from Polish window manufacturer Eko-Okna. This investment marked the long-anticipated return of large-scale logistics transactions and represented over one-third of the total industrial investment volume. Remaining transactions in the sector were all below €80 million each.

The warehouse and logistics sector, with results nearly 2.5 times higher year-on-year, has positioned itself as the main driver of the Polish investment market so far this year.

Investment strategies remain primarily focused on modern assets with strong reversionary potential, but also the appetite for assets with longer WAULTs, where current pricing does not yet fully reflect the premium associated with extended lease terms, is on the rise.

Sector highlights:

• €694 m industrial investment volume in H1 2025

• The largest sale & leaseback deal ever completed across the entire CEE region in H1 2025

• Remaining 11 transactions did not exceed €80 m each in H1 2025

• 3 portfolio deals closed in H1 2025

Office market–opportunities across Poland

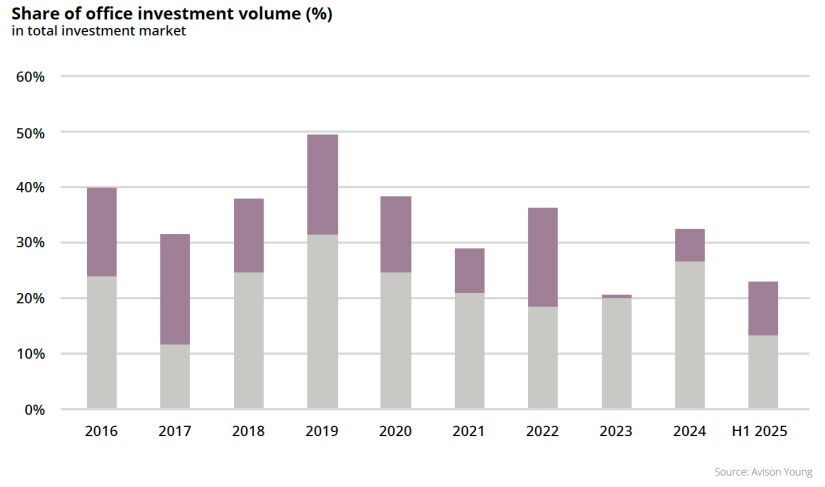

The office investment market in Poland continues to attract strong investor interest, although buyers remain very selective. Value-add and core+ strategies are gaining popularity in specific locations, especially where sellers’ and buyers’ expectations have converged. Interestingly, over 1/3 of the capital invested in offices comes from Polish investors.

”Core capital remains slightly active, as investors pursuing such strategies continue to avoid risks associated with economic and geopolitical uncertainties. Thus, the market saw only three core office deals in H1 2025, namely Wronia 31, Plac Zamkowy – Business with Heritage in Warsaw and High5ive I&II in Kraków. Meanwhile, value-add and opportunistic investors demonstrate greater - albeit cautious - activity, seeking opportunities without overpaying for assets.” – says Marcin Purgal, Senior Director, Investment at Avison Young

Despite the continued cautious approach from investors, premium office assets in regional cities, located in strong locations and offering stable cash flows, may still remain attractive to both institutional and private investors. Thus, in H1 2025 13 out of 23 assets sold were sold outside Warsaw, translating to almost 50% of the office investment volume.

Sector highlights:

• €411 m office investment volume in H1 2025

• 23 deals in H1 2025

• 13 assets sold in regional cities in H1 2025

• Polish capital represented over 1/3 of office investment volume in H1 2025

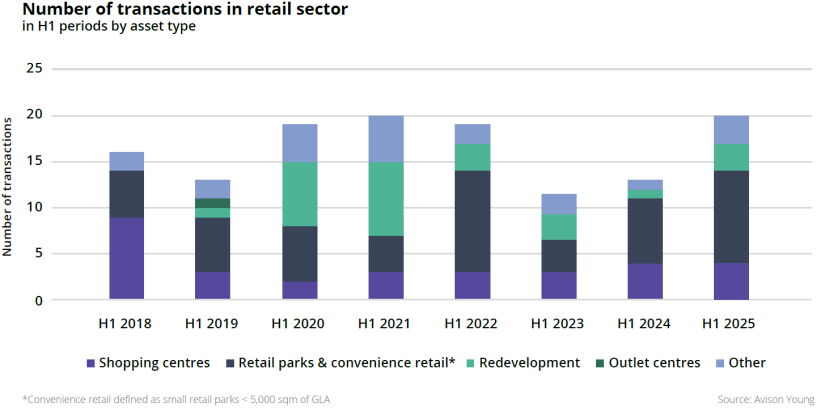

Retail market–redevelopments and continued dominance of retail parks

Following several major “prime” shopping centre transactions in 2024, early 2025 has seen retail parks and convenience centres take the lead in the retail investment market. This asset class, widely regarded as a safe and resilient investment, continues to attract strong interest, accounting for 50% of all closed deals and 59% of total retail investment volume in the first half of the year.

The standout retail transaction of H1 2025 was the acquisition of a 10-asset A Centrum convenience portfolio by Czech-based investor My Park, marking their debut on the Polish market. This was closely followed by the final divestment of Arkady Wrocławskie to Vastint, which is already undergoing demolition. Another notable redevelopment involved CH Glinki in Bydgoszcz, acquired by Redkom Development. In both of these redevelopment transactions, Avison Young represented the sell-side.

“We expect further transactions involving retail parks and convenience-type properties, but attention should also be paid to shopping malls with dominant positions in cities and solid, stable fundamentals. This asset class is currently being widely analysed by investors, and more deals are expected to close shortly.” – says Artur Czuba, Senior Director, Investment at Avison Young.

Sector highlights:

• €322 m retail investment volume in H1 2025

• 20 transactions in H1 2025

• 2 important redevelopment deals brokered by Avison Young

• Debut of new retail park investor from Czechia

PRS–deals done in Warsaw and Gdańsk

The residential market in Poland recorded an investment volume of €223 million in H1 2025, of which €150 million was allocated to three PRS projects in Warsaw. AFI Europe closed two of these transactions, while Syrena RE acquired one asset from Xior Student Housing. The remaining transactions were completed by NREP and involved 3 co-living assets located in Gdańsk, for which Avison Young technical advisory team provided complex advisory, including project monitoring and supervision of construction works.

Currently, over 50% of the existing PRS stock is held by the three major operators. The Resi4Rent platform remains the undisputed leader in terms of completed PRS units, followed by Vantage Rent and the state-owned Fundusz Mieszkań na Wynajem. Together, they manage approximately 11,400 units under the PRS model.

As far as new developments are concerned, Resi4Rent also leads the market, accounting for nearly one-third of flats under construction, followed by Life Spot platform (14%) and Fundusz Mieszkań na Wynajem (10%).

What awaits us in the second half of the year?

• Now is the final time to take advantage of attractive property prices. With interest rate cuts on the horizon, yields are expected to decline, making today’s conditions particularly favorable for buyers.

• Continued activity from mid-cap investors is expected across all commercial real estate asset classes.

• After economic stabilization, core capital, currently only moderately active, is expected to