The rise and rise of impact investing

Impact investing has been growing exponentially all over the world recently, even partially displacing traditional charitable donations.

Impact investing has been growing exponentially all over the world recently, even partially displacing traditional charitable donations.

Impact investing is about funding to make a positive impact on the world. However, its scope is not limited to generating a financial return. You can define the term as an investment intended to generate a measurable positive social and environmental impact alongside a financial return, according to the New York-headquartered nonprofit organization Global Impact Investing Network.

IMPACT INVESTING VS CHARITABLE DONATIONS

Despite some similarities, the investments are not the same as charitable donations, wherein the donor typically expects nothing in return – except, perhaps, a tax deduction. Charities and investments have their own separate and crucial roles. The former are important and effective in meeting immediate needs, such as food, shelter and sanitation. The latter can be more effective in stimulating long-term sustainability through job creation and entrepreneurship.

INTERESTED?

Social impact investments may appeal to a wide variety of individual and institutional investors, including:

• Fund managers

• Development finance institutions

• Diversified financial institutions and banks

• Private foundations

• Pension funds and insurance companies

• Family offices

• Individual investors

• NGOs

• Religious institutions

THE FEATURES

There are three key characteristics of impact investing:

1. Aim: The intention to produce a positive social impact by mobilizing capital is the central idea of the whole concept of impact investing.

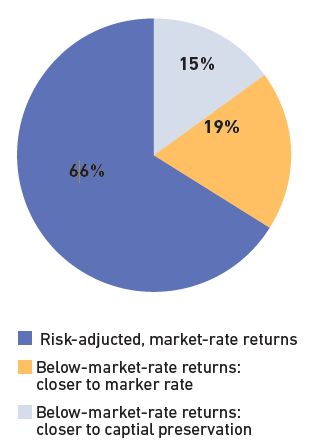

2. Returns: The target range of returns for impact investments may range from below market to market, depending on investors’ strategic goals. Based on a 2019 survey of social impact investors throughout the world, a majority of impact investors still choose to pursue competitive, market-rate returns. But this is not always the case.

3. Effect: The third and most challenging aspect of an investment is the measurement of its impact on the world. GIIN has established the criteria for measuring the effects:

a. Declaring the social or environmental objectives that an investment is attempting to accomplish.

b. Using standardized metrics to set performance targets for these objectives.

c. Utilizing Key Performance Indicators (KPIs) to measure performance and optimizing specific parts of a business model.

d. Reporting social and environmental performance in the context of the standardized metrics that were previously set.

IMPACT INVESTING ROOTS IN CENTRAL EUROPE

According to GIIN, aggregated assets under management in the impact investment industry was estimated at USD 502 billion at the end of 2018. The growing impact investment market provides capital to address the world’s most demanding challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, and housing.

The majority of impact investing organizations are headquartered in developed markets, mainly in the US and Canada. However, impact investing is a global phenomenon, also with strong roots in central Europe. The impact investment ecosystem in the Visegrad countries – Poland, Hungary, Slovakia and the Czech Republic – is relatively well-developed, despite still being in its early stage.

A lack of concise national-level strategies and gaps in cooperation between entities need to be addressed in order for the region to ensure the impact investment ecosystem develops to its full potential, shows an index commissioned by Deloitte, a multinational professional services firm.

For many years, numerous investors have been avoiding investments in the socalled “sin” industries like alcohol, tobacco, armaments, etc. Impact investment might be viewed as an extension of that trend, to actively seek out investments that will make the world a better place. One might also view investing in certain high-tech firms as a form of impact investing, if the technology, for example, medtech or drug research, enriches our lives.

There is a perception in society in general that money is often a source of evil. Impact investing is a positive proof that money can also be the source for good.