Beata Zborowska

Mastery of Management

Vice President & Partner, CFO

Maintaining financial liquidity is a priority for all businesses. But even when a company is profitable and its revenues are increasing, or even has an impressive balance sheet, it may still be in danger of insolvency if the inflows don’t cover current obligations. According to the Center for Economic Information (COIG) estimates, in 2018 a total of 600 companies went bankrupt.

CFO VS INTERIM MANAGER

In a crisis situation, which is what a liquidity loss is, decision-makers usually charge the financial director with finding a solution. Oftentimes this is in vain, because even the most qualified CFO may not have the necessary knowledge and experience to save a company from insolvency. It takes a different set of competencies than managing the finances of a stable company. Besides, a person who is emotionally invested in the company and its employees may find it hard to make difficult choices.

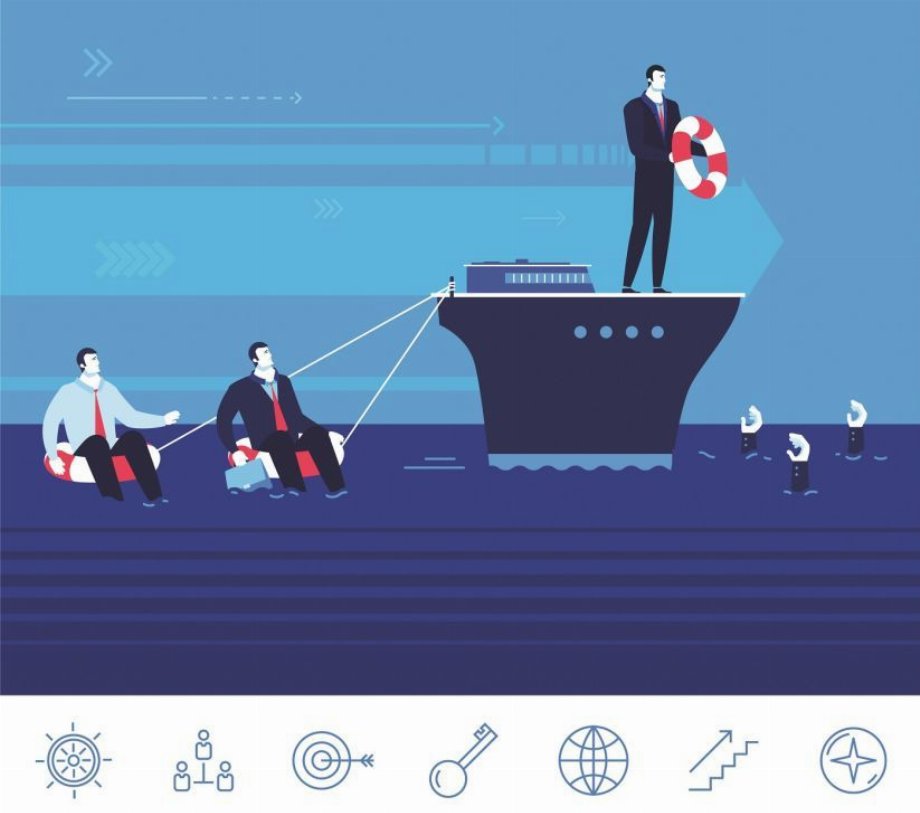

Working together with an interim manager (IM) may be a better solution, and it shouldn’t be seen as an additional cost but as a way of avoiding bankruptcy. One thing that works in favor of IMs is the years of experience in a variety of companies and industries. A large part of an IM’s career is getting companies through a lot of different business problems, so they know best which solutions work in each case.

Besides, an IM is a reformer, not an employee. As a person from outside the organization, they are not driven by emotion or sentiment and do not care how they will be perceived by other employees when difficult personnel decisions need to be taken. Importantly, the role of an IM is to come up with a solution quickly using all the tools available. They are focused on the one task at hand, and – contrary to a CFO – do not need to handle regular CFO duties, such as accounting, financial statements and reporting.

TIME IS OF THE ESSENCE

When implementing financial restructuring, it is crucial how quickly you act. Carrying out a company’s long-term strategy is secondary to generating additional financial resources, through the efficient management of working capital. An IM needs to analyze agreements to identify the suppliers who are critical for the company’s continued operations, and negotiate, for example, longer payment schedules. If a company uses credit loans, it is crucial to renegotiate their conditions, (e.g. secure grace periods for interest payments) or obtain a bridging loan. Alternative sources of financing are also worth considering, for example, through a bond issue or a short-term loan. Selling receivables and factoring can also be a helpful solution.

There are many ways of regaining financial liquidity quickly. However, response time is critical. Meanwhile, CFOs of struggling companies usually see the first signs of a crisis as a temporary problem and often act too late to remedy them. They also frequently misjudge the cost structure of an organization, focusing too much on financial results and disregarding cashflow issues. They often lack the hard negotiation skills which are necessary when dealing with suppliers and investors.

A crisis situation needs immediate and radical solutions, which CFOs are often ill-equipped to find. In that respect, an IM “hired” to solve a particular problem plays an important role. They are not afraid of change and once the crisis has been averted, they can review the current business model and help a company take a new development course and share their knowledge and experience with employees, thus strengthening the company in the future.