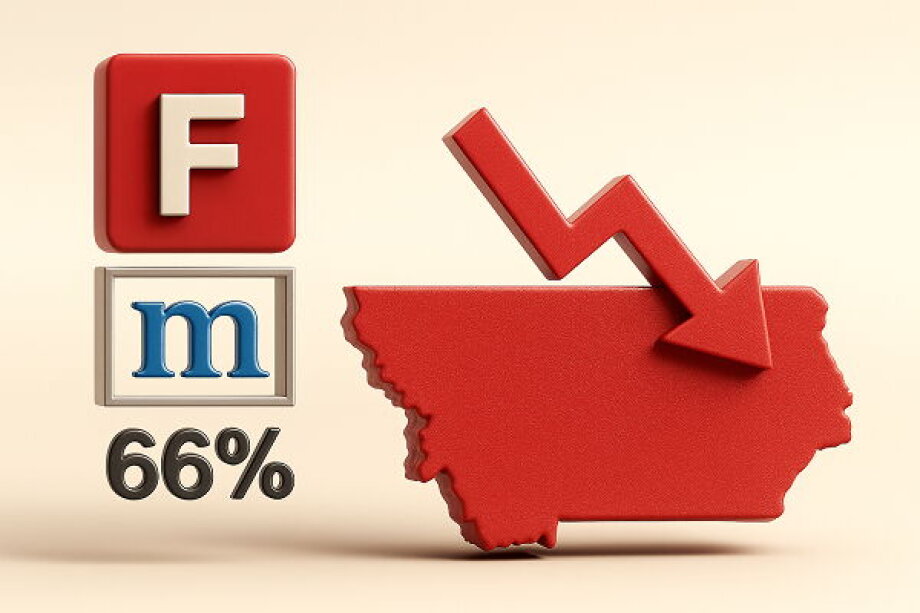

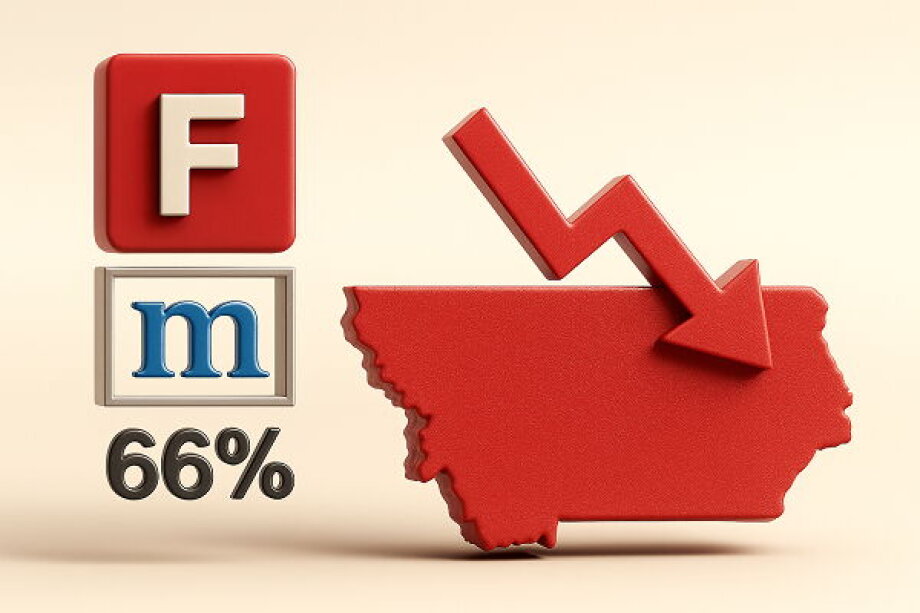

Moody’s Follows Fitch in Cutting Poland’s Outlook, Markets React Calmly

In September, two major rating agencies downgraded Poland’s credit outlook. Fitch acted earlier in the month, and on Friday Moody’s followed, citing a sharp rise in the country’s fiscal deficit path and public debt projections. According to the new budget plan, the debt-to-GDP ratio will reach 66 percent in 2026, compared with previous government pledges to keep it near 60 percent.

Moody’s currently rates Poland’s foreign currency debt at A2, the sixth-highest grade on its 21-level scale. The move increases the risk that Poland’s rating could be cut within the next 1–2 years.

Despite the decision, market impact remains limited. Investors had anticipated the downgrade, and some even feared an immediate rating cut. Poland still benefits from above-EU-average growth and a low current account deficit, cushioning the effect.

For policymakers, the outlook changes are a warning to present credible deficit-reduction plans before markets force harsher adjustments.