Pfizer makes money from vaccines but avoids paying taxes in Europe

The American pharmaceutical company has developed one of the most widely used vaccines against Covid-19 in the world. But, according to investigative journalists from the Netherlands, it avoids paying taxes in Europe by exploiting loopholes in the legislation.

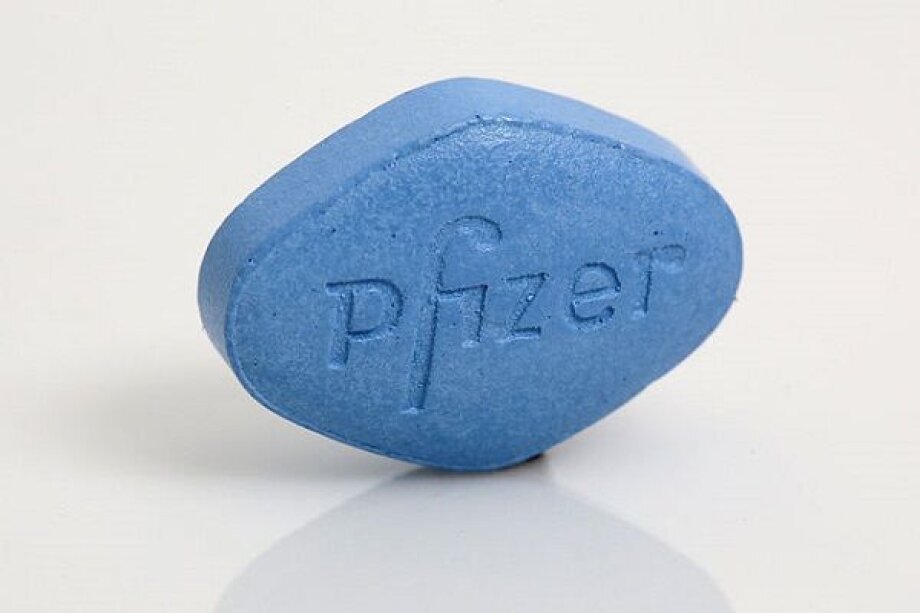

Pfizer is one of the largest pharmaceutical companies in the world. Many of his products are the world's best-selling drugs. It was Pfizer who developed sildenafil to help treat pulmonary hypertension, but it turned out to be a miracle cure for male impotence, marketed under the trade name Viagra. Other very popular Pfizer drugs include the antidepressant drug Zoloft, which helps to treat breast cancer, Ibrance, and the popular pneumococcal vaccine Prevnar. But currently, one of the largest sources of revenue for the American company is a vaccine developed jointly with the German company BioNTech against the coronavirus SARS-CoV2, which causes the disease Covid-19, the trade name of which is Comirnaty.

By the end of 2021, Pfizer only wants to generate revenue of $21 billion from the sale of the last of these products. However, in the first quarter of this year alone, the revenues of the American concern increased by $14.6 billion, or 42 percent more than in 2020. There are many indications that this year will be a true record year.

According to the Dutch investigative portal Follow The Money (FTM), despite huge profits from European markets, Pfizer in 2020 did not pay a penny of CIT nor dividend tax in the European Union. This is to happen thanks to the transfer of European profits to CP Pharmaceuticals International CV (CPPI) registered in the Dutch city of Capelle aan den IJssel. And CPPI, in turn, distributes profits to its founding entities (also controlled by Pfizer) in the form of dividends, which it does not have to tax according to Dutch regulations.